What's going on with Nvidia?

Hey Everyone,

To start off the trading on the stock market in September, 2024, we had a serious down day for Nvidia. According to a Bloomberg report released after US markets closed on Tuesday, the US Justice Department (otherwise known as the DOJ) sent subpoenas to Nvidia Corp. and other companies as it seeks evidence that the chipmaker violated antitrust laws, an escalation of its investigation into the dominant provider of AI processors.

Nvidia shares slumped 9.5% overnight, wiping about $300 billion of its market cap, amid a broad sell-off in U.S. markets. The stock is down another 2.5% in after hours trading.

Nvidia's market capitalization dropped by nearly $280 billion, marking one of its largest one-day market cap losses ever recorded.

Chip stocks have been rising in the past year on optimism that the artificial intelligence boom will require companies to bolster spending but BigTech capex spending on datacenters is increasingly not tethered to ROI at least in any short to medium term sense.

For many of us the huge drop in Nvidia's stock made no sense - Nvidia had the largest market cap drop ever in a single day for a public company on "No news" then subpoena news hits after hours...so clearly a lot of the elites knew this was coming and many aren't even in the name any longer, according to research by CNBC.

A DOJ Probe is an added Risk

The U.S. Department of Justice (DOJ) has issued a subpoena to Nvidia as part of an escalating antitrust investigation. This move is part of a broader probe into Nvidia's business practices, particularly concerning its dominance in the AI processor market. The DOJ is seeking evidence that Nvidia may have violated antitrust laws, which could potentially lead to a formal complaint.

Antitrust officials are concerned that Nvidia is making it harder to switch to other suppliers and penalizes buyers that don’t exclusively use its artificial intelligence chips.

The DOJ, which had previously delivered questionnaires to companies, is now sending legally binding requests that oblige recipients to provide information. Nvidia also faces potential antitrust charges in France and the EU.

The French competition regulator had raided NVIDIA’s local offices in September last year. At the time, they did not disclose the details of the investigation or the company involved, only stating it was related to the graphics card sector.

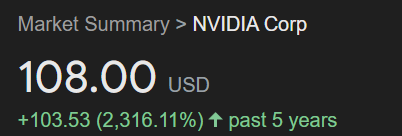

Nvidia is still up 118% for the year after Tuesday’s plunge. Nvidia's stock is up 2,316% in just the last five years, so going down 9% in a single day really isn't that big of a deal.

Nvidia holds a substantial portion of the AI chip market, with estimates suggesting it controls between 70% and 95% of the market share for AI chips. I don't think you get that dominant organically without some unfair practices, but that's just my personal speculation knowing what I know about BigTech.

The reality is that companies like Intel and AMD are little more than afterthoughts and BigTech while they make their own chips are not competitive here. Softbank owned ARM plans to make an AI chip product as early as late 2025 and Broadcom and Marvell may help OpenAI design an AI chip as well. OpenAI plans to build its own AI chips on TSMC's forthcoming 1.6 nm A16 process node according to recent media reports.

Nvidia's dominance raises concerns about potential monopolistic behavior, which has led to scrutiny from regulatory bodies and this is likely to continue as BigTech and a few other Cloud players make huge orders to build AI supercomputers that are getting significantly larger very quickly.